The Life Portfolio Question: Concentration or Diversification?

Today, we have a thought experiment for you.

Think of your time and energy like a financial portfolio. Every block of your day—work, couple time, family time, exercise, friends, logistics—counts as an “investment” aimed at a future return.

ROI of work: purpose and financial stability.

ROI of family time: joy, fun, shared memories.

ROI of exercise: health and longevity (aka “retirement without a walker”).

The purpose of this thought experiment isn't to reduce the vastness of life down to a crass financial calculation. It's to bring your unconscious habits into the light.

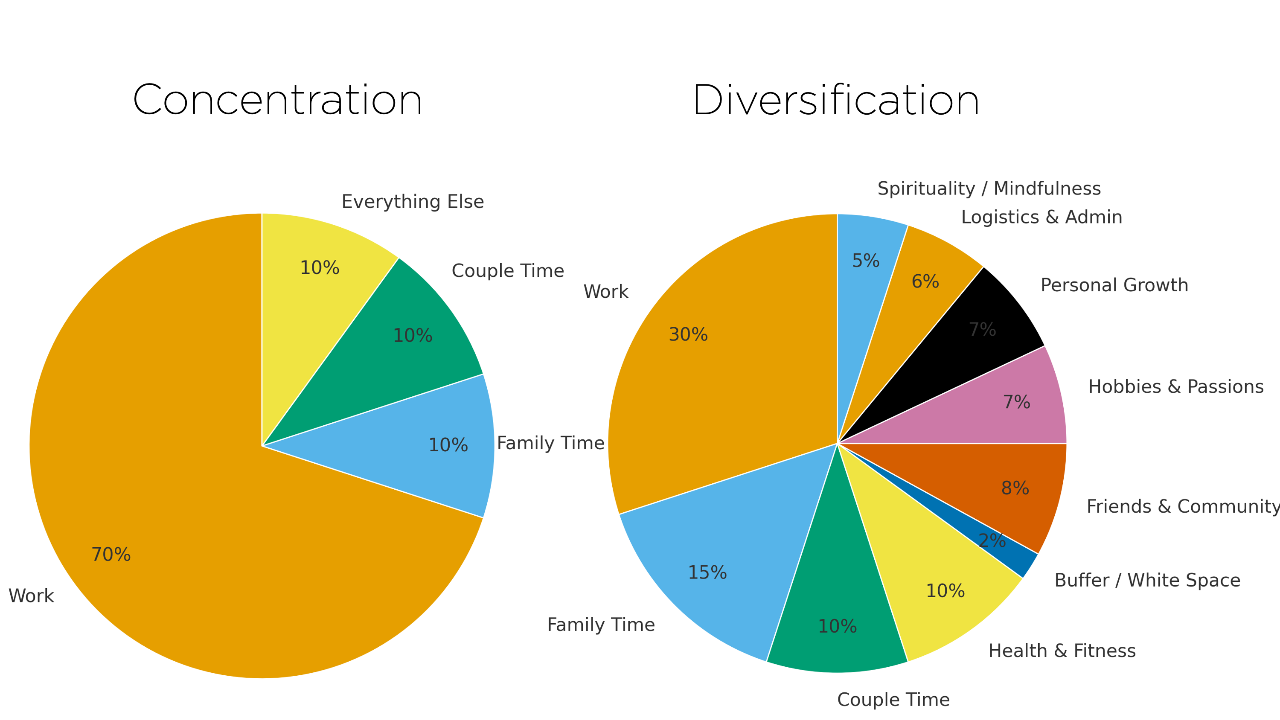

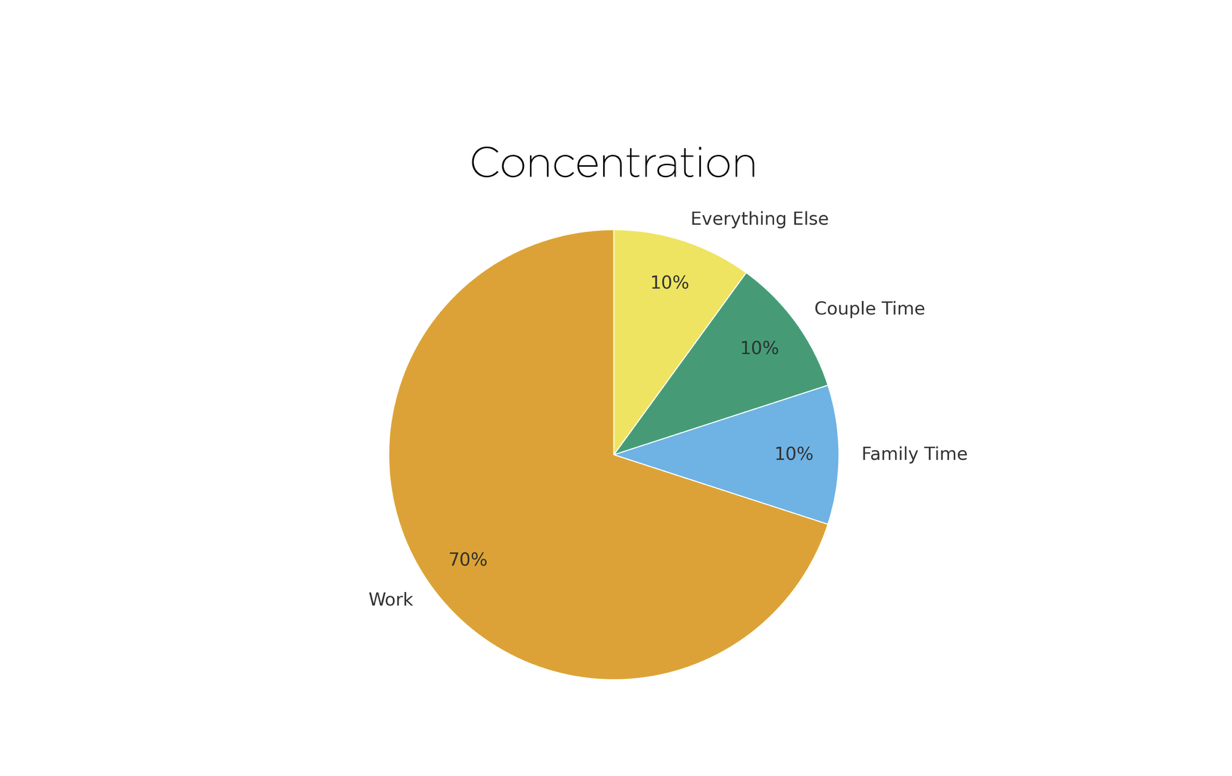

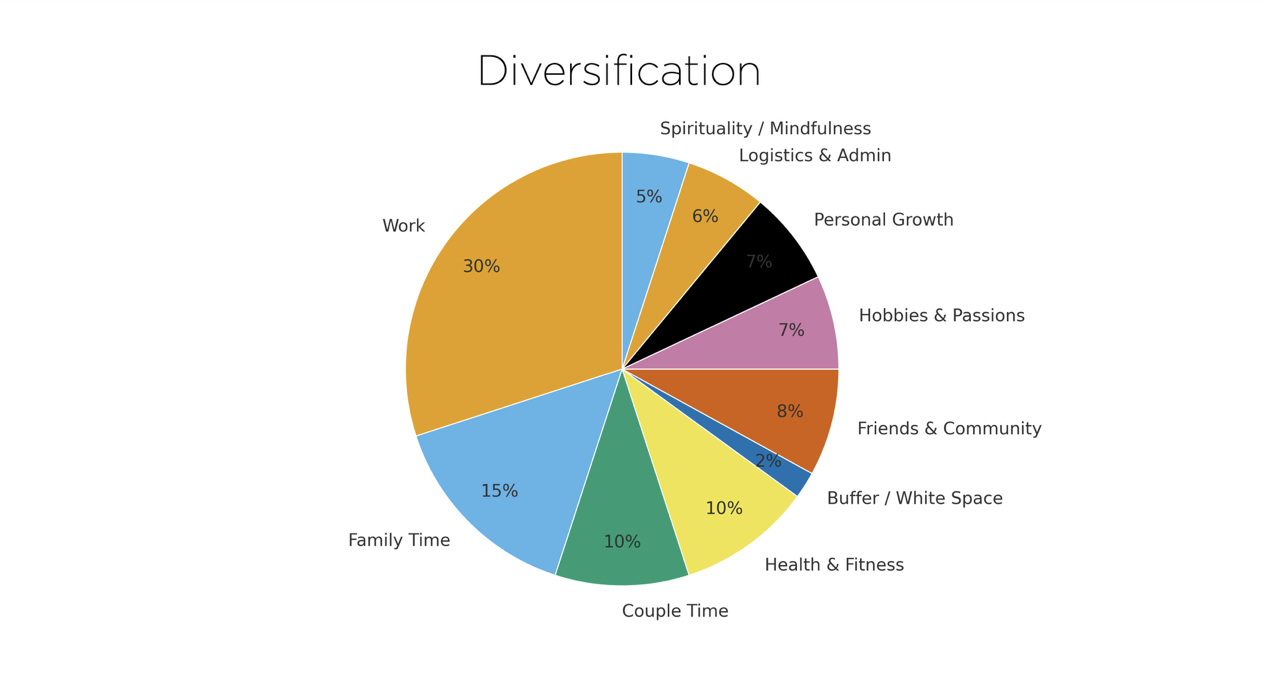

This thought experiment also raises a fundamental question: Is now a season for concentration or diversification?

Here is what each of these life strategies might look like:

There’s no universal right answer.

During some stages of life, focusing almost all of your energy on work, childcare, or family might be the ideal strategy. These are times for concentration.

During other stages of life, a highly diversified life portfolio might be the perfect recipe for experiencing your best life.

What's your ideal life portfolio balance for this season?

1. Identify Your Current Life Portfolio

This sounds like a complicated task. But here's all you have to do.

- Draw a circle on a piece of paper.

- List the main “asset classes” of your life: work, couple time, family, friends, exercise, logistics, spirituality, hobbies, etc.

- Turn the circle into a pie chart sized to reality, not fantasy. (If “Netflix-binging” is a slice, that's okay. We’ve all been there.)

2. Ask: Concentrate or Diversify?

Your current portfolio might already suggest a strategy. Building a business or raising a tiny human? You’re likely concentrated.

Just experienced a career transition, empty nest, or partial retirement? You're likely diversified.

The key point: for most of us, our current allocation strategy happened by accident. Now you get to choose—on purpose.

To do that, reflect on the following:

Question 1: If I move toward a more highly concentrated strategy, where would I invest? If I did, what could become possible in the future that isn't today?

Question 2: If I move toward a more highly diversified strategy, what new areas would I add? If I did, what could become possible in the future that isn't today?

3. Choose Your “For-Now” Portfolio

Shift toward concentration? Diversify? Or keep your life portfolio as is?

There isn’t a single correct answer. The right strategy is the one that maximizes your ability to live with a sense of meaning, connection, and thriving for now.

The key phrase here is "for now." As careers evolve, kids grow, and relationships change, your allocation should also evolve.

Rebalance periodically. Think of it like an index fund, with more date nights.

Bottom line: Don’t let your life portfolio drift by accident. Revisit it with intention, design, and an openness to shift the allocation as life changes.

Want more of these life tools delivered to your inbox?

Sign up for the Klemp Insights Newsletter.